The Strength of the Light-Duty Service Truck

The light-duty service truck is a proven workhorse for the utility industry. With its fairly compact size, compartments and capabilities, it has made operating in the field extremely convenient and efficient. Utilimarc wondered if the truck is still performing strong, or if its prowess is starting to slow down.

Utilimarc analyzed data from over 50 utility fleet benchmarking clients, and sampled over 10,500 light-duty service trucks with a gross vehicle weight rating under 20,000 pounds to find out.

Read how the 4×2 and 4×4 light-duty service truck performed:

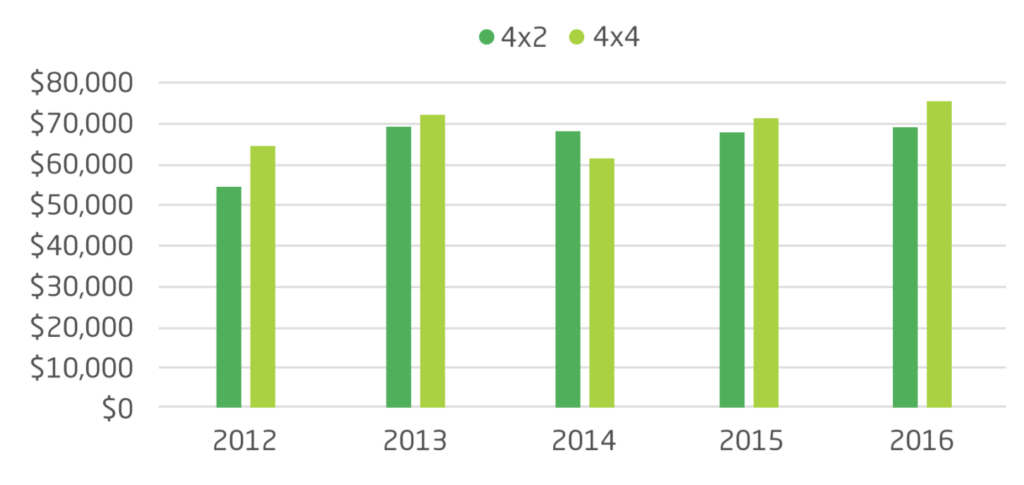

Average Purchase Price Since 2012

The 4×2 always tries to keep up with its bigger 4×4 counterpart, and that didn’t change when it came to purchase price. But while both drive types saw an increase in purchase price from 2012 to 2016, it was the 4×4 that took the lead. It was over 7% more expensive than the 4×2.

The average purchase price for a 4×2 increased from $54,346 to $69,161 — an increase of 21.4%.

The average price for the 4×4 increased from $64,995 to $75,807 — an increase of 14.3%.

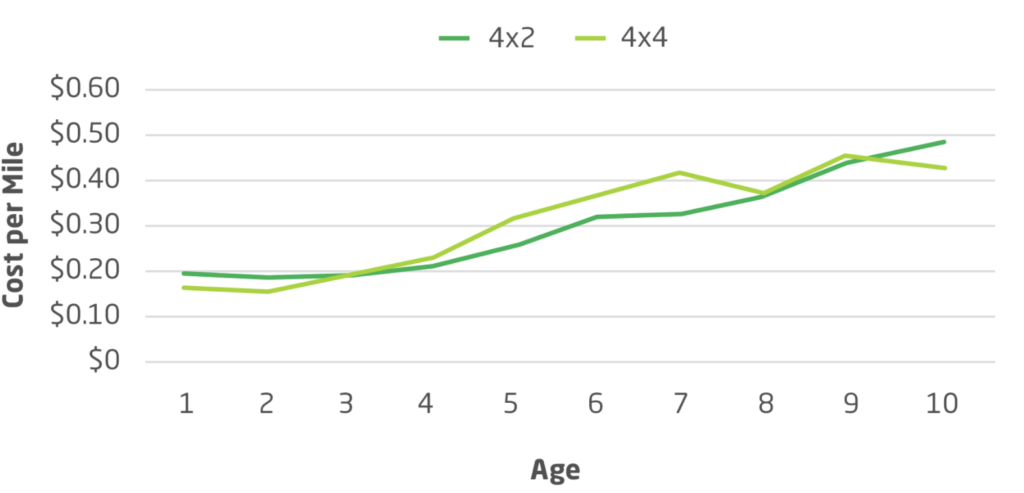

Operating Cost without Fuel Cost Per Mile

We all need a little more upkeep as we age. Same goes for the light-duty service truck. Accounting for all parts and labor, the overall operating cost per mile for both drive types continued to increase as the vehicle aged.

The operating costs for 4×2 in year one was $0.19 per mile, while in year 10 it was $0.49 per mile, an increase of $0.30 over the 10 years. This put the average 10-year operating cost right at $0.28 per mile.

The 4×4 saw a two-cent improvement in operating costs over the 4×2. In year one, the operating cost was $0.16 per mile, while in year 10 it was $0.44 per mile, an increase of $0.27 over the 10 years. Over 10 years, the average operating cost per mile was $0.26.

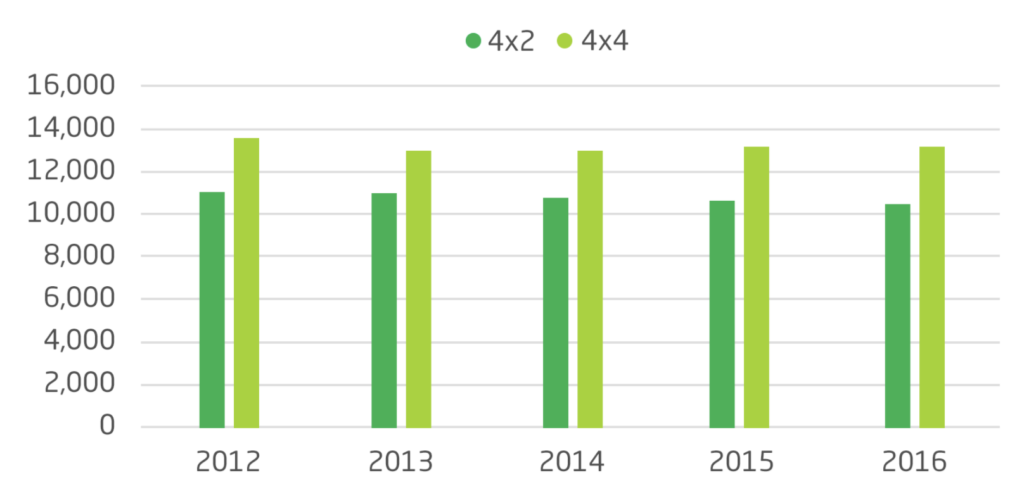

Average Mileage Driven By Year

The light-duty service truck sees a lot of pavement in its lifetime — pretty consistently as well. There were very slight fluctuations in miles driven for both drive types year over year.

On average, however, the 4×4 has historically driven 2,380 more miles annually than the 4×2.

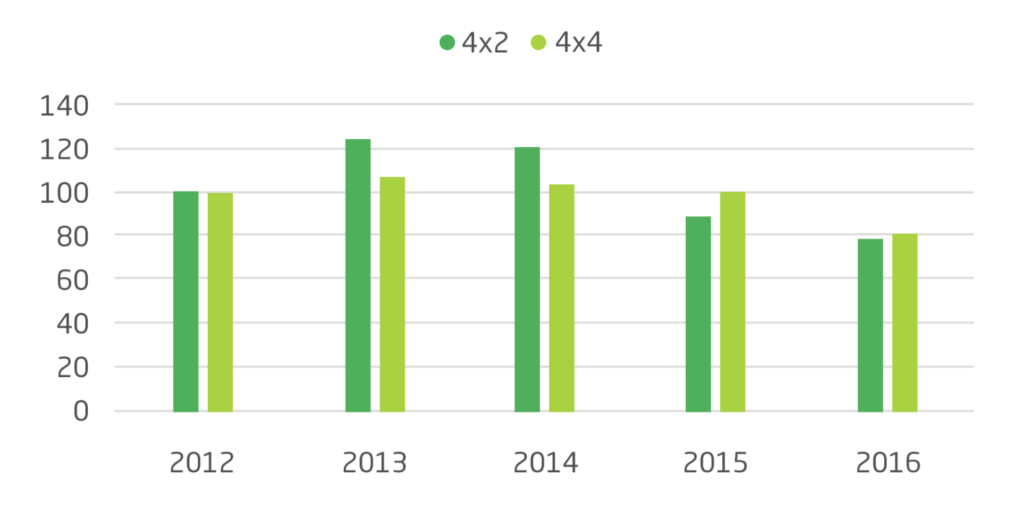

Average Number of Days Between PM (Scheduled) Repairs by Year

Staying on the road longer is one of the easiest ways for a fleet to stay effective. Simply, the less time it spends in the shop, the better. In this metric, the 4×2 beats the 4×4 by a few days.

The 4×2 saw an average of 101 days between PM (scheduled) repair, while the 4×4 was in every 97 days.

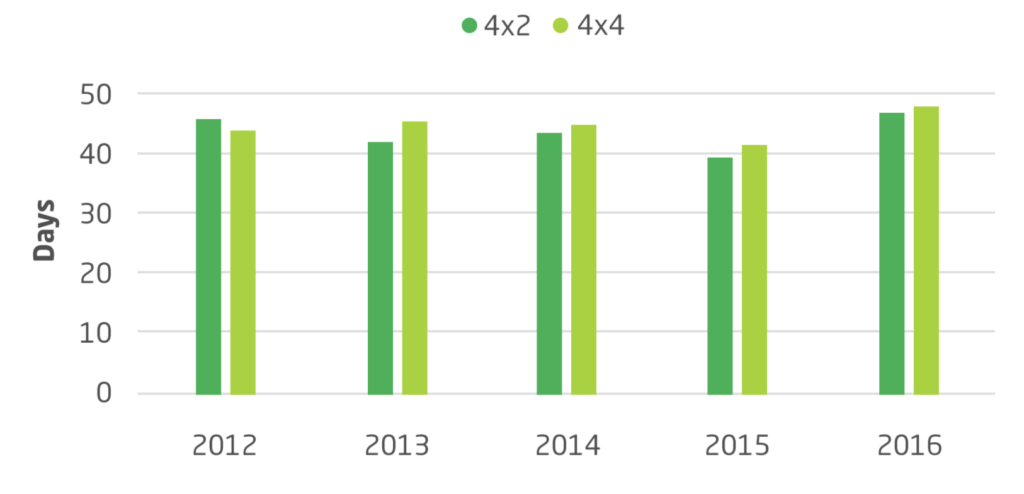

Average Number of Days Between Demand (Unscheduled) Repairs By Year

Surprisingly, positions flipped when it came to unscheduled repairs between drive types.

The 4×4 has a historical average of 45 days between demand (unscheduled) repair, while 4×2 had an unscheduled repair every 43 days.

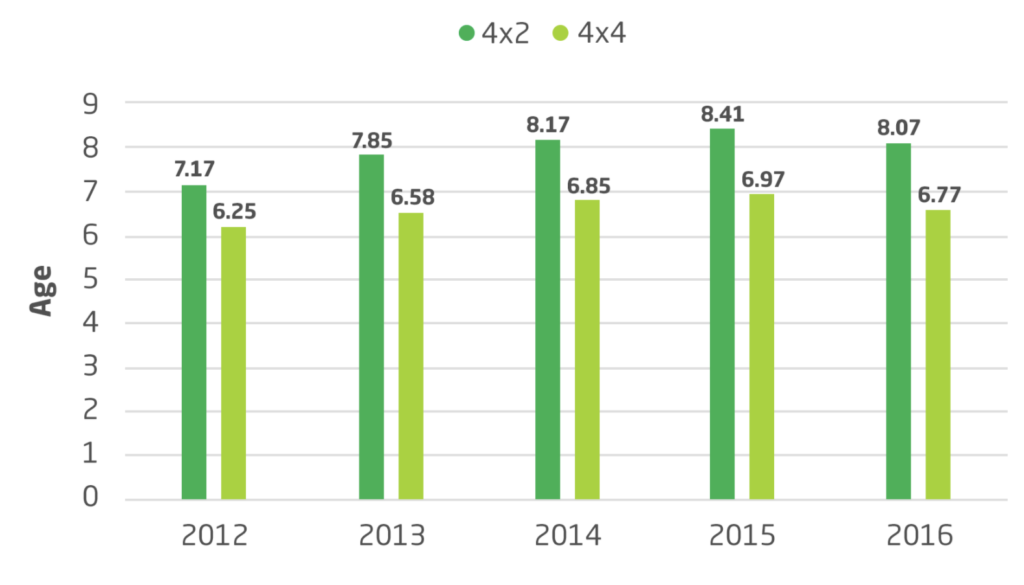

Average Age Since 2012

The light-duty service truck is proving to age gracefully. Except for a slight dip in 2016, the average age of both the 4×2 and 4×4 has steadily increased since 2012.

The average age for the 4×2 increased by 0.90 years, while the 4×4 increased by 0.53 years.

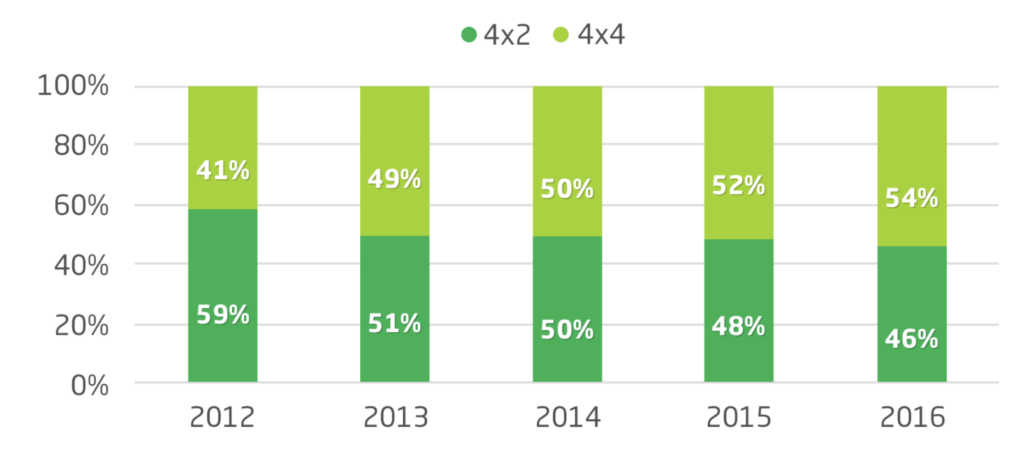

Drive Type Percentage Since 2012

No contest here. The most-popular drive type award goes to the 4×4. It has seen a steady climb from 41% to 54% — an increase of 13% market share over 10 years.

In conclusion

Much like our findings with the light-duty pickup truck, the light-duty 4×4 service truck seems to be taking over the utility fleet scene and has no sign of slowing down.

Paul Milner

Benchmarking and Professional Services Manager

Paul Milner is a Benchmarking and Professional Services Manager at Utilimarc. He studied mathematics and philosophy at the University of St. Thomas in Minnesota. Working at Utilimarc for nearly ten years, he helps find the stories and solve problems within complex data sets. See more from Paul